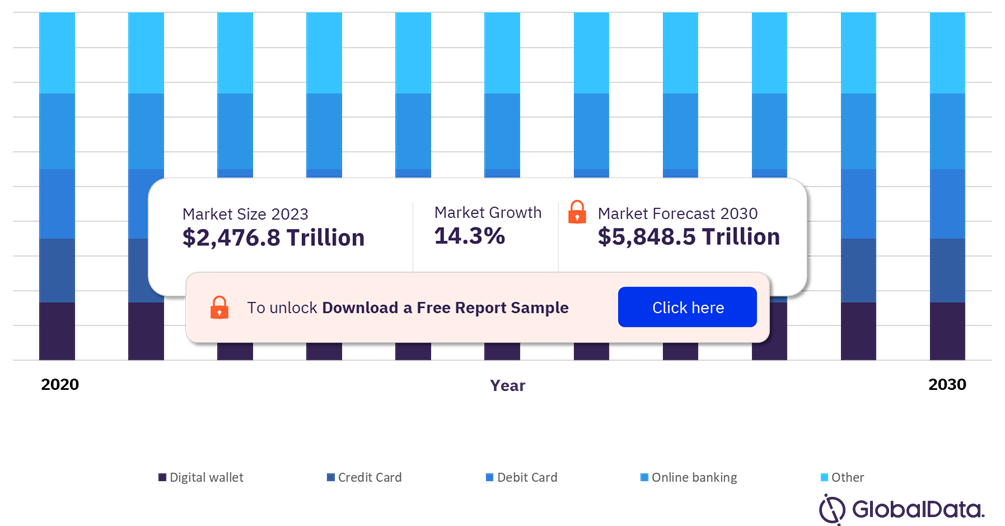

According to a new report by GlobalData Plc, the global digital payments market size is expected to reach $5,848.5 trillion in terms of transaction value by 2030. The adoption of digital payments will be supported by high level of convenience offered as they allow users to make transactions quickly and easily from anywhere at any time. They eliminate the need for physical cash or checks, which can be inconvenient and time-consuming to handle.

Global Digital Payments Market by Mode of Payment, 2023 (%)

Digital payments market outlook report with detailed technology segment analysis is available with GlobalData Now! Read our free sample report

Digital Payment FAQs

- What was the global digital payment market size in 2023?

The digital payment market size globally by transaction value will be $2,476.8 trillion in 2023.

- What is the digital payment market growth rate?

The global digital payment market is expected to grow at a CAGR of 14.3% over the forecast period (2023-2030).

- What is the key digital payment market driver?

Convenience and security offered by digital payments along with the globalization of ecommerce are some of the major factors driving the market growth.

- What are the key digital payment market segments?

Mode of Payment: Digital Wallet, Credit Card, Debit Card, Online Banking, Others

End-use Industry: Retail, Hospitality, Entertainment, Healthcare, Others

- Which are the leading digital payment companies globally?

The leading digital payment companies are Alibaba Group Holding Ltd, American Express Co, Apple Inc, Google LLC, Mastercard Inc, PayPal Holdings Inc, Visa Inc, Discover Financial Services, ACI Worldwide Inc, Amazon.com Inc, Fiserv Inc, One97 Communications Ltd., Samsung Electronics Co Ltd, Fidelity National Information Services Inc, and The Western Union Co.

Have more queries pertaining to digital payment market, download free sample report

Digital Payment Market Dynamics

A digital payment is the transfer of value from one payment account to another using a digital device such as a mobile phone, POS (Point of Sales) or computer, a digital channel communication such as mobile wireless data or SWIFT. Digital payments do not involve cash or cheques. The evolution of the digital payments industry is closely linked to the creation and emergence of the internet. The digital payments industry was initially built to accommodate card payment transactions, but with the emergence of new technology, it is currently transforming. We have already seen a shift in the payment options available to consumers like online banking and digital wallets.

The market faces significant challenges from lack of infrastructure and security concerns which are expected to impact growth over the forecast period. Digital payments require a reliable and fast internet connection, which is often lacking in many parts of the world. This makes it difficult for people in rural or remote areas to access digital payment platforms. Digital payments are vulnerable to fraud, including identity theft, account takeover, and phishing attacks. Cybercriminals can steal user credentials, use malware to intercept transactions, or set up fake websites or apps to trick users into providing their personal and financial information.

Learn about the digital payments market dynamics by viewing report sample right here!

Digital Payment Market Report Highlights

- The digital payment market by transaction volume is expected to grow at a compound annual growth rate (CAGR) of 14.3% during 2023-2030 owing to significant increase in demand for digital payments due to the ease and convenience they offer, globalization in ecommerce, and favorable government initiatives.

- Hospitality is expected to be the highest industry category for the digital payments market. The use of digital payment methods in foodservice has become increasingly popular in recent years, driven by the rise of smartphone adoption and the growing demand for convenient and secure payment options.

- Governments in many developing countries have launched initiatives to promote financial inclusion, which often includes promoting digital payments to increase access to financial services for underserved populations. These initiatives may include providing incentives for digital payment providers to expand their services into rural areas or launching public education campaigns to increase awareness of digital payment options.

- Asia Pacific, accounted for a significant share of the overall digital payment transactions in 2022. Rising disposable incomes and digital penetration in countries such as China, India, and Indonesia, will favor the proliferation of the digital payments market in the Asia Pacific market.

- The key digital payments market players analyzed in this report include Alibaba Group Holding Ltd, American Express Co, Apple Inc, Google LLC, Mastercard Inc, PayPal Holdings Inc, Visa Inc, Discover Financial Services, ACI Worldwide Inc, Amazon.com Inc, Fiserv Inc, One97 Communications Ltd., Samsung Electronics Co Ltd, Fidelity National Information Services Inc, and The Western Union Co., among others.

Unlock additional market dynamics impacting the digital payments market growth by requesting a sample PDF

Global Digital Payments Market Segments and Scope

GlobalData Plc has segmented the global digital payments market report by mode of payment, industry, and region:

Global Digital Payments Market Mode of Payment Outlook (Transaction Value and Volume, $Trillion and Trillion, 2020-2030)

- Digital wallet

- Credit Card

- Debit Card

- Online banking

- Other

Global Digital Payments Market Industry Outlook (Transaction Value and Volume, $Trillion and Trillion, 2020-2030)

- Retail

- Hospitality

- Entertainment

- Healthcare

- Other End-user Industry

Global Digital Payments Market Regional Outlook (Transaction Value and Volume, $Trillion and Trillion, 2020-2030)

- North America

- The US

- Canada

- Asia-pacific

- Australia

- India

- Indonesia

- Japan

- Singapore

- China

- Korea

- Malaysia

- Rest of Asia Pacific

- Europe

- Russia

- Belgium

- Germany

- Italy

- Spain

- Ireland

- Denmark

- Finland

- Netherlands

- Poland

- Sweden

- France

- UK

- Rest of Europe

- South and Central America

- Mexico

- Brazil

- Colombia

- Argentina

- Peru

- Rest of South and Central America

- Middle East and Africa

- South Africa

- Turkey

- Saudi Arabia

- Rest of Middle East and Africa

Get a segment-wise and regional opportunities as you grab your sample report copy

Related Reports

- Business to Consumer (B2C) eCommerce Market Size, Share, Trends, Analysis by Region, Payment Type (Online, Offline) and Segment Forecast to 2026

- Buy Now Pay Later (BNPL) Market Size, Share, Trends, Analysis and Forecasts by Spend Category (Clothing & Footwear, Furniture, Travel & Accommodation, Sports & Entertainment) and By Region and Segment Forecast, 2023-2026

- Cloud Computing in Banking – Thematic Intelligence

About us

GlobalData is a leading provider of data, analytics, and insights on the world’s largest industries. In an increasingly fast-moving, complex, and uncertain world, it has never been harder for organizations and decision-makers to predict and navigate the future. GlobalData’s mission is to help our clients to decode the future and profit from faster, more informed decisions. As a leading information services company, thousands of clients rely on us for trusted, timely, and actionable intelligence. Our solutions are designed to provide a daily edge to professionals within corporations, financial institutions, professional services, and government agencies.

Contact Information:

GlobalData Mark Jephcott Head of PR EMEA [email protected] cc: [email protected] +44 (0)207 936 6400

Tags:

Reportedtimes, iCN Internal Distribution, Extended Distribution, Research Newswire, English