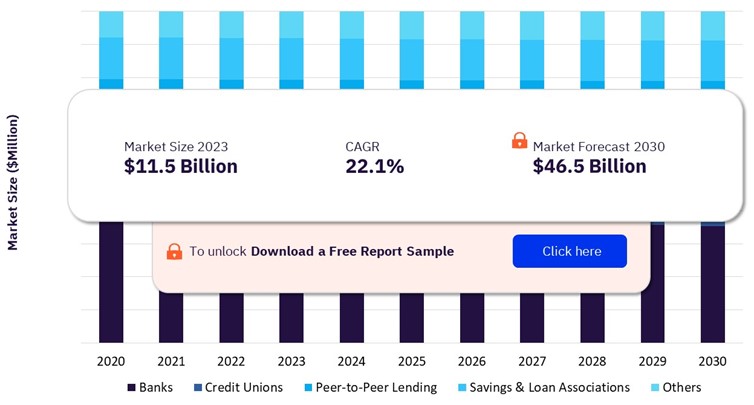

The global digital lending platforms market size will reach $11.5 billion in 2023, according to a new report by GlobalData Plc. The market will be driven by the growing digitalization in the banking and finance sector which are generating new opportunities for digital lending platforms. According to the Global Findex Index from the World Bank, in developing economies, the share of adults who make or receive digital payments grew from 35% in 2014 to 57% in 2021.

Digital Lending Platforms Market by End Use, 2020 – 2030

Digital Lending Platforms market outlook report with detailed segment analysis is available with GlobalData Now! Download a FREE sample!

Digital Lending Platforms Market FAQs

- What was the global Digital Lending Platforms market size in 2023?

The Digital Lending Platforms market size globally will be valued at $11.5 billion in 2023.

- What is the Digital Lending Platforms market growth rate?

The global Digital Lending Platforms market is expected to grow at a CAGR of 22.1% over the forecast period (2023-2030).

- What is the key Digital Lending Platforms market driver?

The increased demand for digital channels, faster loan approvals and disbursements, and integration of emerging technologies in the lending platforms are some of the major factors driving the market growth.

- What are the key Digital Lending Platforms market segments?

o Type: Software, Services

- Software: Loan Origination, Loan Management, Analytics & Insights, Others

o Deployment: Cloud, On-premise

o End Use: Banks, Credit Unions, Peer-to-Peer Lending, Savings & Loan Associations, Others

- Which are the leading Digital Lending Platforms companies globally?

The leading Digital Lending Platforms companies are EdgeVerve Systems Limited, Fidelity National Information Services Inc. (FIS), Finastra Group Holdings Ltd, LendingTree, LLC, Roostify Inc., BlendLabs Inc., Newgen Software Technologies Limited, Nucleus Software Exports Ltd., One97 Communications Ltd, and Wipro Limited.

Got more queries? Have all your questions answered in this PDF sample

Digital Lending Platforms Market Dynamics

The COVID-19 pandemic has positively impacted the use of digital lending platforms, as traditional banking services faced limitations due to lockdowns and social distancing measures. People turned to online platforms for their financial needs. Digital lending platforms provide a convenient and accessible way for individuals and businesses to access loans and credit remotely. Moreover, the growing significance of open banking is generating new prospects for market growth globally. Open banking facilitates the lenders to effectively put together the borrowers’ data, such as credit scoring, current outstanding debts, and previous loans, among others. This assists the lenders in accelerating their decision processes and providing tailored lending solutions to the clients based on their needs.

Learn about the digital lending platforms market dynamics by viewing report sample right here!

Digital Lending Platforms Market Report Highlights

- The global digital lending platforms market is projected to witness growth owing to increased financial inclusivity and access to credit, which has fueled the growth of the digital lending platforms.

- The services segment is expected to register the fastest growth during the forecast period, owing to the increased focus on sustained customer relationships and proactive risk management.

- The analytics & insights software segment is anticipated to witness the highest demand from 2023 to 2030 due to the rising need for lending analytics stemming from the vast amount of data generated.

- The cloud segment is likely to register the fastest growth during the forecast period, attributed to the reduction in up-front costs by eliminating the need for significant hardware investments and infrastructure setup.

- The peer-to-peer (P2P) lending end use segment is anticipated to register the highest CAGR during the forecast period owing to its ability to connect borrowers directly with investors.

- Asia Pacific will account for the largest market share, followed by North America in 2023.

- The major digital lending platforms market players analyzed as part of this report include EdgeVerve Systems Limited, Fidelity National Information Services Inc. (FIS), Finastra Group Holdings Ltd, LendingTree, LLC, Roostify Inc., BlendLabs Inc., Newgen Software Technologies Limited, Nucleus Software Exports Ltd., One97 Communications Ltd, and Wipro Limited, amongst others.

Unlock additional market dynamics impacting the digital lending platforms market growth by requesting a sample PDF.

GlobalData Plc has segmented the Digital Lending Platforms market report by type, software, deployment, end-use, and region:

Digital Lending Platforms Market – Revenue Opportunity Forecast, by Type, 2020-2030 ($M)

- Software

- Loan Origination Software

- Loan Management Software

- Analytics & Insights Software

- Others

- Services

Digital Lending Platforms Market – Revenue Opportunity Forecast, by Deployment, 2020-2030 ($M)

- Cloud

- On-premise

Digital Lending Platforms Market – Revenue Opportunity Forecast, by End Use, 2020-2030 ($M)

- Banks

- Credit Unions

- Peer-to-Peer Lending

- Savings & Loan Associations

- Others

Digital Lending Platforms Regional Outlook (Revenue, $M, 2020-2030)

- North America

- The US

- Canada

- Europe

- Germany

- The UK

- France

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Central & South America

- Brazil

- Mexico

- Rest of Central & South America

- Middle East & Africa

- Saudi Arabia

- The UAE

- Rest of Middle East & Africa

Know segment-wise insights as you grab your sample report copy

Related Reports

- Digital Lending – Thematic Research

- Digital Payments Market Size, Share, Trends and Analysis by Region, Mode of Payment (Digital Wallet, Credit Card, Debit Card, Online Banking, Others), Industry (Retail, Hospitality, Entertainment, Healthcare, Others), and Segment Forecast, 2023-2030

- Buy Now Pay Later (BNPL) Market Size, Share, Trends and Analysis by Spend Category (Clothing and Footwear, Furniture, Travel and Accommodation, Sports and Entertainment), Region and Segment Forecast to 2026

- Banking and Payments Predictions in 2023 – Thematic Intelligence

- Digital Banking Trend Analysis – The Quest for Profitability Driving Strategies and Product Development of Digital-Only Providers

- Trends in Banking – Report Bundle (9 Reports)

About us

GlobalData is a leading provider of data, analytics, and insights on the world’s largest industries. In an increasingly fast-moving, complex, and uncertain world, it has never been harder for organizations and decision-makers to predict and navigate the future. GlobalData’s mission is to help our clients to decode the future and profit from faster, more informed decisions. As a leading information services company, thousands of clients rely on us for trusted, timely, and actionable intelligence. Our solutions are designed to provide a daily edge to professionals within corporations, financial institutions, professional services, and government agencies.

Contact Information:

GlobalData Mark Jephcott Head of PR EMEA [email protected] cc: [email protected] +44 (0)207 936 6400

Tags:

Reportedtimes, Extended Distribution, iCN Internal Distribution, Research Newswire, English